Our Portfolio Echoes of Harmony: Investing with Purpose for Impactful Change

At Sabancı Holding, we consistently invest in sustainable businesses, including energy and climate technologies, material technologies and mobility solutions, and digital technologies, to foster resilience for future generations and drive impactful change towards a sustainable economy.

Sabancı Group reinforces its role as a global player with its contribution for a sustainable future and creates enduring value for its stakeholders. By combining its solid financial structure, dynamic portfolio management and robust sense of corporate governance with its innovation and technology-oriented business approach, Sabancı Group is not only delivering a strong growth from its core businesses but also gaining significant opportunities in new growth platforms.

Investing in New

Growth Platforms

We believe that Sabancı Holding can seize opportunities through strategic business development initiatives fostering growth platforms, while encompassing a wide range of sustainable investment themes to keep pace with innovations on this front.

We continuously monitor global trends and align our strategy accordingly for sustainable growth.

Accordingly, Sabancı Holding focuses on specific initiatives under the theme of the “New Economy”, including energy and climate technologies, material technologies and mobility solutions, and digital technologies.

Our Growth Platforms will be key in capturing the demand on Nature and Climate-driven Transformation

As Sabancı Group, we started to track SDG-linked activities in 2022. During 2023, TL 0.7 billion have been allocated for investments in these activities.

Our CapEx and OpEx will reach USD 5 billion in SDG-linked activities by 2027, with climate mitigation and adaptation having a share of 70%.

We are acting through capital allocation criteria targeting high-growth global mega trends in sustainability.

We are doubling non-bank CAPEX (Capital Expenditures) to Revenues to accelerate both organic and inorganic growth, 25/75 split between core & new investments.75% of non-bank CAPEX to Revenues is allocated for transformation & adjacencies focusing on energy and climate technologies, material technologies and mobility solutions, and digital technologies to achieve higher FX generation, to increase the share of non-regulated business and to reach our Net Zero emissions target.

In our mid-term guidance for 2021 to 2025 period, we announced our target for the share of New Economy, that is revenues generated from energy and climate technologies, material technologies and digital technologies, in combined non-bank revenue at the end of period to reach approximately 13%.

Our performance for the period 2021 to 2023 was on track, as the share of new economy reached 11% compared to 6.6% in 2021.

For detailed information on our operations under energy and climate technologies, material technologies and mobility solutions, and digital technologies, please download Transforming Our Portfolio Section.

Impact

Investment

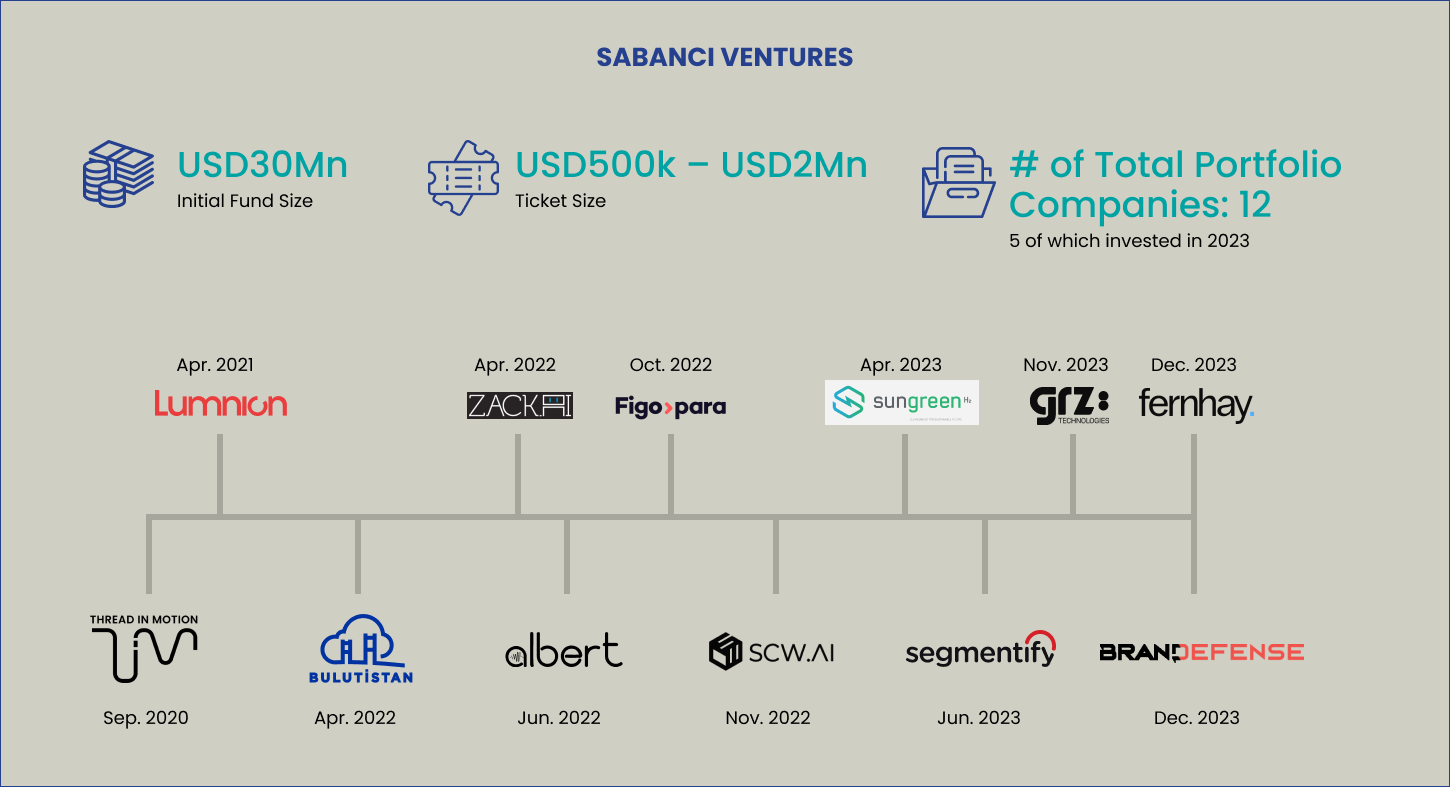

Sabancı Ventures (“SV”) is the corporate venture capital arm of Sabancı Holding. SV adopts global best practices and creates value for both parties with solid commercial partnership plans, leveraging the know-how, operational excellence, and global network of Sabancı Group companies.

Sabancı Holding incorporates SDG-linked metrics into its investment analysis and decision-making processes in line with the Holding’s Strategy House direction. To this end, those investments deemed acceptable by Sabancı Ventures must support the sustainability values of Sabancı Holding.

SV accepts the UN Principles for Responsible Investment (PRI)’s six principles as a guide for evaluating investment decisions. With the six Principles of PRI, Sabancı Ventures

strives to create a positive impact with its investments besides implementing a portfolio-wide ESG-related risk assessment.

SV establishes whether a potential investment meets the requirements of ESG risk management, the ethical principles of participation, and legal requirements or regulations such as those on anti-corruption. Then, SV aims to identify & eliminate the potential negative social and/or environmental impact of the new investment while incentivizing the other party to adopt a positive social and/or environmental stance.

As a corporate VC fund, Sabancı Ventures invests in post-revenue scaleups and seeks solid synergies and value creation opportunities between its future portfolio companies and Sabancı Group companies. SV strives to

find exceptional founders with scalable business models and help them realize their global expansion potential. Typically, SV invests in post-seed to Series A stage companies, though it can also invest in later stage companies.

Sabancı Ventures acts as a “sensor” for Group companies to identify new growth areas, actively evaluating investment opportunities with innovative business models and/or cutting-edge technologies.

SV focuses on burgeoning areas such as fintech, martech, cybersecurity, climate tech, Internet of Things (IoT) & wearable, insurtech, cloudtech, healthtech, AI (Artificial Intelligence) and mobility.

Investing in Tech-based Start-ups via Sabancı Ventures

Sabancı Ventures has made direct corporate venture capital investments in 12 companies in five countries and has deployed over USD 12 million to date. Five of these investments were completed in 2023. As a part of its overall corporate venture capital strategy, Sabancı Group uses several investment vehicles where the total number of direct investments reached more than 17 companies and total investments exceeded USD 45 million between 2020 and 2023.

2022 & 2023 Performance# OF COMPANIES

Sabancı Ventures invests in companies with the ambition to support Sustainable Development Goals (SDGs). It discusses impact objectives and identifies at least one SDG and its relevant Key Performance Indices (KPIs) to monitor the impact of investment in pre-investment processes. Once investments are made, Sabancı Ventures continuously monitors & updates the KPI status and determines optimization measures based on those KPIs.

Sustainability for a Better

Life 2023 Report

Sustainability for a Better

Life 2023 Report