- Agile global/local footprint at scale

- Digital & AI transformation

- Innovation for growth

- Sustainability for a better life

- Future-ready organization & talent

Creation Echoes of Harmony: Navigating Change Through Value Creation

At Sabancı Holding, we embrace this dynamic approach by transforming our businesses and investing in new growth platforms, preserving our foundational strengths while innovatively creating value in an ever-evolving world.

- PPE & intangible assets*: TL 91.5 bn

- Net debt/EBITDA: 0.8x

- Non-bank CapEx/Sales: 11%

- Total Dividends Received: TL 7 bn

* Data per IAS29 financials

VALUE ADD

- Combined revenue growth: 57%

- Combined EBITDA growth: 23%

- Consolidated net income growth: 20%

- Consolidated ROE: 34.4%, 2021-2023

- Holding-only Net Cash Position: TL 7 bn

- NAV growth: 85.6%

- New Economy Share: 11%

- FX Revenue Share: 21%

- Dividends per Share: TL 1.75

- Existence in 14 Countries and 6 Continents

- Diversified portfolio in non-financial and financial industries

VALUE ADD

- TL 0.7 billion investment deployed in new economy areas in 2023

- 17+ companies with direct investment through Sabancı Ventures

- 75% of non-bank CapEx to revenue allocated for transformation & adjacencies focusing on new economy areas

- Development of new infrastructure and technological capabilities

- Fostering a culture of innovation by creating an ecosystem

- Strengthening market position by investing in high-growth new economy potential area

- +60k employment

- Talent programs (i.e. SEED Young Talent Program, The New Generation Career Experience Program)

- Specialized training programs (i.e. IN-LEAD, X-TEND, X-LAB)

- TL ~ 5 thousands training expenditure per FTE

VALUE ADD

- 41% ratio of women managers

- 34% ratio of women employees in STEM positions

- 1.6 million+ hours of total trainings given to employees

- 90% of unionized blue-collar employees

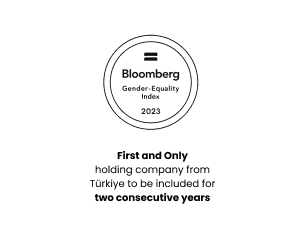

- Ensuring equitable and inclusive workplace resulted with inclusion in Bloomberg GEI two years in a row

- Increasing employee well-being and satisfaction resulted in 64% employee engagement score and 84% employee satisfaction score

- Enhancing the organization's overall skill set and innovation capacity through increasing STEM positions

- Boosting Sabancı Group's R&D and innovation for strategic growth

- 8 total R&D Centers, 6 in Türkiye; 2 abroad

- Cross company innovation programs

- Data and digital trainings

- Venture capital investments

- In-house entrepreneurship programs

- Academia partners (i.e. Sabancı University)

VALUE ADD

- 219 new SDG-linked products and services

- TL 1.3 billion R&D and innovation investments with TL 661 million SDG-linked focus

- TL 226 billion sustainable finance provided

- Opening of Sabancı Global Technology Center GmbH (SGTC) in Germany

- Opening of Asia Pacific Technological Center in Indonesia

- TL 49 billion SDG-linked products and services revenue

- 9% share of SDG-linked products and services revenue in total non-bank revenue

- Enhancing collaborative ecosystem with worldwide R&D Centers, i.e. reintroduction of Çimsa and Kordsa products to the European market through SGTC

- Increasing digital literacy and skills of Sabancı Group employees through digital trainings

- 33 million MWh energy consumption

- 8 million m3 water consumption

- TL 6.8 billion environmental investments and expenditures

VALUE ADD

- Group-wide collaboration programs on nature

- 15 GHG reduction initiatives

- 12 ESG topics addressed in business development R&D and innovation programs

- 10% reduction in Scope 1 and 2 GHG emissions

- 5% reduction in water consumption

- 38% ratio of water reused

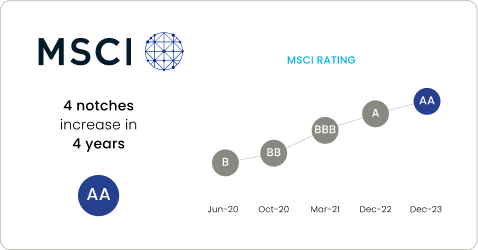

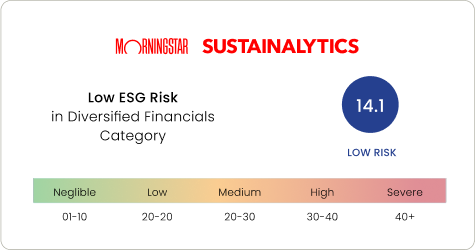

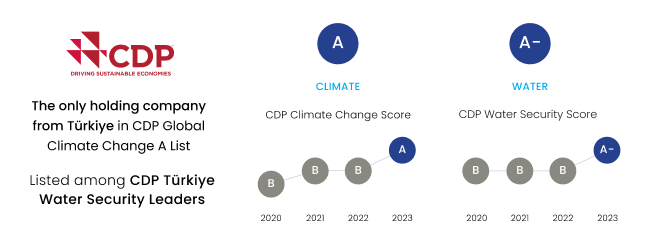

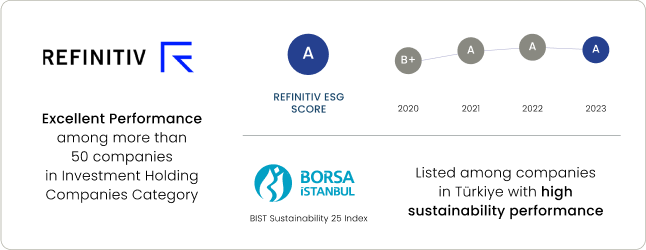

- High performance in sustainability indices

- Positive environmental impact with the reduction of more than half million sm3 of natural gas usage, 70 thousand MWh electricity and 300 thousand tCO2e emissions through SDG-linked investments/activities

- Investment in CSR activities with high social impact

- Türkiye’s biggest social responsibility initiative via Sabancı Republic Day Campaign

- NGO partnerships (i.e. Sabancı Foundation)

- 28,000+ local suppliers and 1,400+ foreign suppliers

- 6 global business partners

- Customers in diversified industries

VALUE ADD

- 1.8+ million people reached through inclusion programs

- 170+ thousand hours spent for activities as part of Sabancı Republic Day Campaign

- 2,000+ Sabancı Volunteers in the 45th Istanbul Marathon to support education and development

- 4.6 million people involved in projects supported by Sabancı Foundation grant programs

- International CSR Excellence Gold Award 2023 for Sabancı Volunteers Program

- 1 ≤ SROI ≤14.18

- European Sustainability Award for Güler Sabancı on behalf of Sabancı Holding

- Contributing to social equity by providing opportunities and resources to vulnerable groups

- Encouraging and facilitating employee participation in voluntary activities

- Long-lasting impact on social development and contribution to more intellectual and inclusive society

CAPITAL

CAPITAL

CAPITAL

CAPITAL

CAPITAL

VALUE ADD OUR PURPOSE

We unite Türkiye and the World for a sustainable life with leading enterprises

- Energy & climate technologies

- Material technologies

- Mobility solutions

- Banking

- Financial services

- Digital

- Other

TO UN SDGs

TO UN SDGs

TO UN SDGs

TO UN SDGs

TO UN SDGs

TO UN SDGs

2023 Sustainability

Indicators at a Glance

9Inclusion programs refer to the community investment programs developed by the group companies. The number of vulnerable groups reached through these programs was followed by the breakdown of citizens over the age of 65, youth, children and socio-economically disadvantaged groups. Akbank, Agesa, Aksigorta, Brisa, Carrefoursa, Çimsa, Enerjisa Üretim, Enerjisa Enerji, Kordsa, Temsa and Teknosa are included. 10 The figure represents the cumulative value for over 17 years. 11 Agesa, Aksigorta, Akçansa, Brisa, Carrefoursa, Çimsa, Kordsa, Teknosa, Temsa, Enerjisa Enerji, Enerjisa Üretim, and SabancıDx are included. 12 Akbank and SBS BV are not included. 13 This refers to the principle of equal pay for equal work. 14 Akbank is not included. 15 Carrefoursa, Akçansa, Çimsa, Brisa, Kordsa, Enerjisa Enerji and Temsa are included.

For detailed information on Preserving and Creating Value, Aligning Financial Success with Long-Term Value Creation and sustainability developments, please download Our Value Creation Section

Pioneering Sustainability

in Targets and Actions

Sabancı Holding is the first holding company in Türkiye to announce Net Zero Emissions target by 2050.

We have committed to a 15% reduction in Scope 1 & 2 GHG emissions by 2025 and a 42% reduction by 2030 versus 2021 baseline without using carbon offsets.

* Sabancı Holding’s GHG emissions have been calculated by using the equity share approach in accordance with the Greenhouse Gas Protocol.

Accordingly, Sabancı Holding accounts for GHG emissions from operations according to its share of equity in the operation.

** Assumptions based on analysis conducted in 2023.

*** Installed capacity.

**** Total waste increase mainly attributable to increase in non-hazardous waste of Carrefoursa.

***** Committed by Akbank, in addition to their sustainable investment funds commitment reaching TL 15 billion until 2030.

We are the first holding company to issue a Responsible Investment Policy. By 2027, our cumulative SDG-linked investments will reach USD 5 billion.

In 2023, 50% of overall Sabancı Group R&D and innovation investments were allocated to areas that serve SDGs.

2023 marked the generation of our pilot green hydrogen in Türkiye’s first Hydrogen Valley.

We are developing Türkiye’s first inter-city hydrogen bus following the launch of Europe’s first intercity electric bus.

Our renewables portfolio will reach 4 GW by 2026 including the largest onshore wind energy project in Europe.

Sabancı Group operates Türkiye’s largest electric vehicle high speed charging station network.

A member of Net-Zero Banking Alliance, Akbank sets ambitious targets, aiming to become a Net Zero Bank by 2050. The Bank exceeded its TL 200 billion Sustainable Financing goal for 2030 by the end of 2023 with TL 226 billion and raised it to TL 800 billion.

Akbank is committed to increasing the sustainable investment fund balance to TL 15 billion in Assets under Management by 2030.

* Committed by Akbank, in addition to their sustainable investment funds commitment reaching TL 15 billion until 2030. The target has already been exceeded in 2023.

Akbank has established a new target which is amounting TL 800 bn Sustainable Finance Pledge until 2030.

** All figures are presented cumulatively.

***The target is planned to be completed as of 2025.

Sabancı Group’s Social Agenda highlights our keen commitment to making a significant, measurable impact on society.

Sabancı Volunteers’ project, Sabancı Republic Day Campaign, once again became Türkiye’s most attended social responsibility initiative in 2023.

Sabancı Holding has implemented specific quotas to promote gender equality. The Holding has achieved equal pay for equal work and established a 50% women quota in all development programs, along with a 30% women quota in the Senior Management recruitment shortlist. These quotas are part of its broader goals of enhancing gender diversity and inclusivity within leadership, STEM and revenue generating roles by 2030.

In the last three years, Sabancı Group appointed 3 women CEOs and 3 women Executive Committee Members. All Group companies have women Board Member at their Board of Directors.

Disclaimer: The use by Sabancı Holding of any MCSI ESG research LLC or its affiliates (“MSCI”) data, and the use of MSCI logos, trademarks, service marks or index names herein, do not constit ute a sponsorship, endorsement, recommendation, or promotion of Sabancı Holding 3 by MSCI. MSCI services and da ta are the property of MSCI or its information providers, and a re provided ‘as-is’ and without warranty. MSCI names and logos are trademarks or service marks of MSCI.