at Sabancı Group Echoes of Harmony: Integrating Sustainability for a Resilient Future

At Sabancı Holding, we design an ecosystem informed by awareness of megatrends and emerging risks, leading transformation and investments that create a positive impact on society and the environment.

Our Material

Issues

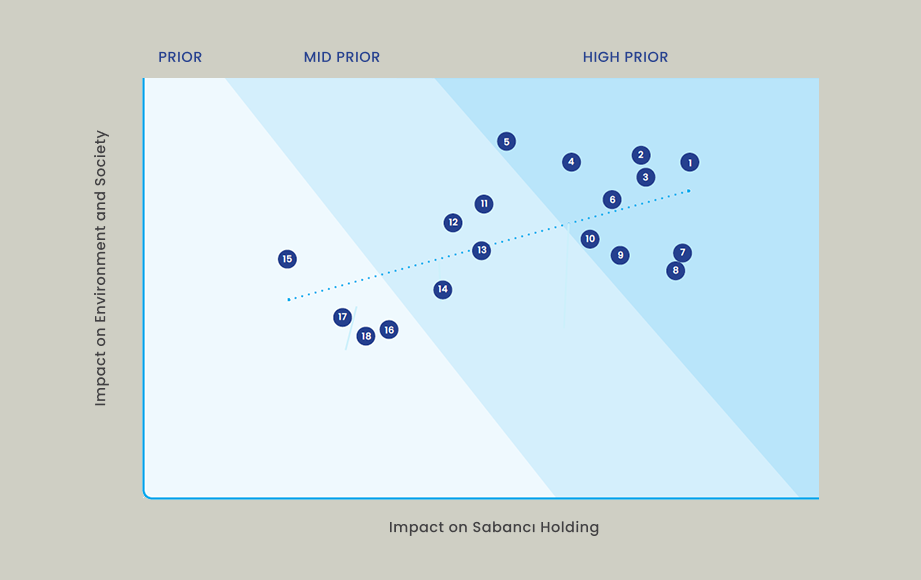

To determine our material issues for 2023, we conducted a double materiality analysis, considering evolving international standards. Our goal was to identify material issues from a comprehensive perspective, ensuring the participation of both our internal and external stakeholders.

Comprehensive Risk and Opportunity Assessment

Through international standards, ESRS requirements, and literature review, we compiled a list of 152 risks and opportunities, and 114 positive and negative impacts relevant to all current and future issues for Sabancı Holding. This list is designed to be reviewed annually until the double materiality analysis is renewed after two fiscal years.

Evaluating Sustainability Impacts

We assessed our sustainability impacts, risks, and opportunities across the entire value chain. In line with ESRS requirements, we evaluated impact materiality based on the magnitude, scope, manageability of negative impacts, and frequency of occurrence. On the financial materiality side, we considered the financial impacts of risks/opportunities and the frequency of occurrence. These evaluations have been integrated into the Enterprise Risk Management (ERM) process with the input of Sabancı Holding's Risk Department.

The results of our 2023 double materiality analysis were signed by the Holding Executive Committee and the Board Sustainability Committee.

Third-Party Audit and Validation

The materiality assessment process at Sabancı Holding is verified by a third-party assurance provider to ensure the accuracy, credibility, and transparency of our evaluation. This independent verification affirms that our methodology, data collection, and analysis align with the international standards, providing confidence to our stakeholders in the robustness of our materiality determinations. Through this verification, we demonstrate our commitment to accountability and continuous improvement in our sustainability practices.

Double Materiality Matrix

2 Climate Emergency

3 Circular Economy

4 Responsible Investment and Sustainable Business Models

5 Talent Management

6 Corporate Governance

7 Opportunity Management and Agility

8 Digital Technologies

9 Collaboration and Effective Communication with Stakeholders

10 Risk Management and Resilience

11 Innovation and R&D

12 Supply Chain Management

13 Reputation Management

14 Organizational Health and Safety

15 Social Contribution and Investments

16 Human Rights and Equal Opportunity

17 Biodiversity and Nature Positive Actions

18 Cyber Security and Data Privacy

Sustainability Trends and Our Response to Emerging Risks

By embracing interconnected megatrends and addressing key material issues, we aim to mitigate risks, seize opportunities, and ensure long-term success in an increasingly complex and uncertain world.

Through the double materiality analysis, we have identified key issues that guide our sustainability strategy and business decisions. In addressing these trends and risks, we have not only focused on business resilience but also emphasized issues and actions where we can create a positive impact in alignment with our stakeholder expectations.

To support these efforts, we have implemented respective policies, procedures, and measurements, ensuring a proactive and structured approach to managing both inside-out and outside-in impacts on our operations.

TREND

There is a global push towards clean energy resources, driven by concerns over climate change and energy security.

EMERGING RISK

Mismatch between the scale of clean energy needed to address clean energy transition and the amount of financing, while political pushback threatens to hinder progress towards a sustainable energy transition in some regions such as US. Limited financing and regulatory barriers may affect investment in R&D initiatives aimed at driving technological innovation in the renewable energy sector.

RELATED MATERIAL ISSUES

Climate Emergency, Digital Technologies, Innovation and R&D

OUR RESPONSE

Sabancı Group has integrated climate-related risks into its Enterprise Risk Management (ERM) system and is undertaking a Sustainable Energy Transformation. This includes investments in renewable energy sources and energy trading to improve energy security and accelerate the clean energy transition. By leveraging diverse funding sources and exploring innovative financing mechanisms such as green bonds and impact investing, we aim to bridge the financial divide and accelerate the deployment of clean energy technologies. We are actively collaborating with industry associations and advocacy groups to amplify our collective voice and advocate for policies conducive to clean energy deployment. For further details please visit Transforming our Portfolio section.

OPPORTUNITIES

Expansion into renewable energy markets presents opportunities for growth and innovation. Sabancı Group leverages its expertise to become a leader in sustainable energy solutions, driving revenue and growth in the new economy. Additionally, expansive research & development activities and investments & partnerships with technology firms facilitate the development of cutting-edge clean energy technologies. Through Sabancı Ventures and Sabancı Climate Ventures, we aim to contribute to the climate emergency by investing in climate technologies and digital technologies to accelerate renewable energy transformation.

TREND

World Economic Forum (WEF) Global Risk Report 2024 suggests that the threshold for triggering long-term, potentially irreversible and selfperpetuating changes to select planetary systems is likely to be passed at or before 1.5°C of global warming, which is currently anticipated to be reached by the early 2030s.

EMERGING RISK

Failure to meet emissions reduction targets could have severe environmental and economic consequences. Nearly all environmental risks are included in the top 10 global risks for the decade ahead, namely extreme weather events, natural resource shortages, biodiversity loss and ecosystem collapse in WEF Global Risk Report 2024.

RELATED MATERIAL ISSUES

Climate Emergency, Responsible Investments and Sustainable Business Models, Biodiversity and Nature Positive Actions, Circular Economy

OUR RESPONSE

Sabancı Group has committed to achieving Net Zero emissions and Zero Waste by 2050 at the latest, in alignment with Science-Based Targets Initiative (SBTi) and Sustainable Development Goals (SDGs). Accordingly, we will reduce our Scope 1 & 2 GHG emissions by at least 15% by 2025 and 42% by 2030 vs. 2021 baseline without using carbon offsets. We also continue investments in renewable energy and climate technology, as well as SDG-linked investments and research and development (R&D). For further details please visit Decarbonization Initiatives and Transforming our Core Business Areas sections.

OPPORTUNITIES

Leading the transition to a low-carbon economy presents opportunities for Sabancı Group to differentiate itself in the market and attract environmentally conscious stakeholders across the board. Additionally, investments in energy and climate aim to decarbonize the physical and digital economy, power demand without CO2 emissions, and drive innovations in carbon capture and storage, creating new revenue streams and partnerships across industries focused on reducing carbon footprints.

TREND

According to the United Nations World Water Development Report 2024 published by UNESCO, on behalf of UN-Water, today 2.2 billion people still live without access to safely managed drinking water and 3.5 billion lack access to safely managed sanitation. The report highlights that water crises threaten world peace.

EMERGING RISK

Water is an essential component for the survival and success of any business, regardless of its sector of activity. In our business portfolio, water has a significant role in sustaining the operational continuity of our Energy Generation and Material Technologies companies.

RELATED MATERIAL ISSUES

Climate Emergency, Responsible Investments and Sustainable Business Models

OUR RESPONSE

In response to potential risks associated with water scarcity and to ensure effective management of water, we initiated a comprehensive water project across the Group in 2023. With this project, we define our impact on water resources on an industry basis and carry out studies on efficiency, recovery, and savings to manage water sustainably. Our total water consumption in 2023 decreased to 8 million m³, while total water discharged increased to 342 million m³. Across the Group, the percentage of water recycled and reused in 2023 was 38%. For further details please visit Water Management section.

OPPORTUNITIES

Effective water management improves our resilience to water-related risks such as scarcity, quality issues, and regulatory changes. Besides, investing in water-efficient technologies and solutions creates new opportunities for synergy. With this aim, we encourage the entrepreneurs via our ARF (Almost Ready to Fly) program which aims to support open innovation and provide mentoring, structural support, and pre-seed investment to help entrepreneurs take off. In recent years, through this program, we have supported the growth of a startup dedicated to water efficiency. We are delighted to share that this company has begun collaborating with our Group Companies, working on projects aimed at optimizing water usage. This achievement highlights the effectiveness of our commitment to fostering innovation and sustainability.

TREND

There is growing concern over biodiversity loss and deforestation, necessitating action to preserve ecosystems.

EMERGING RISK

There are potential negative impacts due to biodiversity loss and deforestation, such as disrupted supply chains and increased costs from regulatory fines or reputational damage.

RELATED MATERIAL ISSUES

Responsible Investments and Sustainable Business Models, Biodiversity and Nature Positive Actions

OUR RESPONSE

To address and minimize potential risks, Sabancı Group initiated a comprehensive biodiversity project in 2023, across the Group Companies. Through this project, we analyzed our impact on and reliance on biodiversity, with Group Companies mapping their value chains to determine areas for effective interventions. For further details please visit Biodiversity section.

Additionally, our Responsible Investment Policy outlines exclusion criteria based on various biodiversity standards, applicable to all investments regardless of size, and mandates adherence to IFC (International Finance Corporation) Performance Criteria or EBRD (European Bank for Reconstruction and Development) Performance Requirements for significant investments exceeding USD 10 million, particularly those with substantial environmental or social risks. Furthermore, the Policy outlines procedures for conducting ESG due diligence, including biodiversity considerations, throughout the Sabancı Group value chain.

OPPORTUNITIES

Sabancı Group undertakes biodiversity conservation programs and cooperates with local public and non-governmental organizations, as well as formulating plans with international collaborations such as the EBRD.

TREND

As emphasized in the WEF Global Risk Report, persistent inflation, which is predicted to ease by 2024, could lead to a renewed rise in living costs due to ongoing higher prices. The delayed effects of tighter monetary policy and reduced consumer purchasing power may impact major economies. This may lead to significant social challenges due to limited economic opportunities and widening inequalities.

EMERGING RISK

Inadequate responses to living wage concerns may lead to social unrest and talent shortages, especially in the face of geopolitical tensions and economic downturns. Deteriorating physical and mental health conditions present potential risks that may necessitate medical intervention or restrict daily activities. In addition, there are other challenges such as higher costs and disrupted supply chains due to persistent inflation, potentially leading to reduced profits and difficulties in meeting customer demand. Moreover, widening economic inequalities and regulatory changes may further complicate business operations and impact long-term sustainability.

RELATED MATERIAL ISSUES

Human Rights and Equal Opportunity, Talent Management, Financial Performance

OUR RESPONSE

Sabancı Group implements inclusion programs and supports livelihoods through financial assistance, grants, and scholarships. We provide an equal, fair, and safe work environment for our employees to best realize their potential and ensure a living wage enabling a decent standard of living. Our Human Capital Strategy aims to instill a human-centric approach to promote sustainable lifestyles, fostering connections that prioritize personal touchpoints and continuous learning for general well-being and vitality. Our Group companies also take initiatives based on various sectoral needs.

This includes initiatives which enhance financial literacy acros s society. We support the strong representation of our workforce through unionization. The unionization rate among onsite employees is 91%, which is 77 percentage points above the national average. Furthermore, we monitor and audit whether our subcontractor employees are insured while regular social security premiums and salary payments are made. In addition, we focus on optimizing supply chains and innovating cost-effective solutions, alongside efforts to address economic inequalities, are key for sustaining business resilience and fostering long-term success in a challenging environment. For further details please visit Our Social Agenda and Our Human Capital sections.

OPPORTUNITIES

By addressing social inequalities, Sabancı Group enhances employee well-being, leading to a more resilient and engaged workforce. Ensuring fair wages and benefits not only promotes our employee loyalty but also attracts top talent in a competitive job market. We invest in employee development and well-being that leads to higher job satisfaction and lower turnover rates, also reducing recruitment and training costs. Moreover, through our inclusion programs and partnerships, we strengthen relationships with local communities and create opportunities for mutual benefit, such as access to new markets and talent pools.

TREND

Emerging trend of enhanced sustainability skillsets in board rooms, also highlighted in MSCI's 2024 Sustainability and Climate Trends Report, started to shape corporate governance strategies for companies aiming for tangible sustainable achievements. One of the most growing trends is the increasing integration of climate risk into corporate governance, where boards are expected to oversee and manage climate-related risks and opportunities in more detail through incorporating sustainability-related metrics into executive compensation and ensuring sustainabilityrelated risk disclosures aligned with international standards.

EMERGING RISK

Boards are expected to oversee and manage climate-related risks and opportunities in alignment with international standards more thoroughly. Failure to effectively manage these responsibilities, due to a lack of required knowledge and experience, could result in regulatory noncompliance, financial penalties, reputational damage, and missed opportunities for sustainable growth.

RELATED MATERIAL ISSUES

Corporate Governance, Human Rights and Equal Opportunity

OUR RESPONSE

Sabancı Holding goes beyond the requirements of local legislation in determining the Board of Directors' appointment by actively supporting diversity, including candidates from different backgrounds and experiences, as outlined in the Diversity Policy for the Board of Directors Policy. Sabancı Holding's Board of Directors prioritizes sustainability by ensuring a comprehensive skill set among its members. The Board evaluates candidates based on industry knowledge, management expertise, ESG proficiency, and crisis management experience, with a commitment to gender equality and diversity. The skills matrix of the Board of Directors clearly demonstrates that competencies on critical issues are thoroughly considered.

In addition, the Board Sustainability Committee is responsible for overseeing material ESG-related issues on the Holding’s agenda. The Board Sustainability Committee, comprised of three independent board members and the Sustainability Director as the Rapporteur, enables members to stay updated on the global sustainability agenda, thereby strengthening the governance mechanism. The Committee helps the mitigation of potential risks as board members remain well-informed about key sustainability topics. For further details please visit Our Governance section.

OPPORTUNITIES

A diverse and ESG-focused board provides valuable insights and strategic direction for Sabancı Group, guiding the company towards sustainable growth and resilience. Moreover, board diversity enhances stakeholder trust and confidence, attracting employees, customers, investors, and business partners aligned with the company's values and long-term objectives.

TREND

Cybersecurity is evolving rapidly to address the growing complexity and sophistication of cyber threats. One key trend is the increasing adoption of AI to detect and respond to threats in realtime, improving the ability to identify anomalies and predict attacks. The rise of remote work has heightened the need for robust cybersecurity measures, leading to greater investment in secure access solutions. Cloud security is becoming more critical as organizations migrate their data and applications to the cloud through extended security features. In addition, the regulatory landscape is also tightening, with new regulations and compliance requirements pushing organizations to enhance their data protection practices.

EMERGING RISK

According to the WEF’s 2024 Global Risks Report, the increasing sophistication of cyber threats, including malware, deepfakes, and misinformation, will cause a persistent risk. These threats can decrease public trust, disrupt operations, and damage the company's reputation. Additionally, the growing cyber-attacks targeting critical infrastructure and supply chains can result in significant financial losses and operational disruptions in different industries such as banking, financial services, energy etc. Besides that, the trend towards remote work and increased reliance on digital platforms also increase the risk of cyber-attacks, necessitating enhanced cybersecurity protocols and employee training. Moreover, regulatory changes and tightening compliance requirements add to the complexity, requiring continuous adaptation to meet evolving standards and avoid legal problems.

RELATED MATERIAL ISSUES

Cybersecurity and Data Privacy, Digital Technologies, Risk Management and Resilience

OUR RESPONSE

Sabancı Group acknowledges the critical importance of cybersecurity and has integrated cyber risk management into its governance strategies. The establishment of a Data Protection Committee underscores the commitment to adopting and implementing industry best practices to address emerging cyber threats. Collaborating closely with the cyber security team, Sabancı Group implements comprehensive security measures to safeguard its operations and data. This includes regular assessments, updates, and enhancements to the cybersecurity infrastructure. The Audit Department conducts regular checks of company processes and systems to determine and eliminate operational risks. The Information Technology Department manages technology risks – damage to information systems, cyberattacks, and the like – via preventive actions, regular tests and back up plans. Sabancı Holding also crafted a comprehensive, experiential cybersecurity training program, including cyber threats in 2023. Furthermore, Sabancı Group has taken proactive steps to mitigate cyber risks by securing cyber risk insurance. This strategic measure ensures effective cybersecurity coverage and helps to mitigate technological risks, bolstering the resilience of the organization against potential cyber threats. For further details please visit Enterprise Risk Management at Sabancı Group and Digitalization for Sustainable Business Models sections.

OPPORTUNITIES

By investing in innovative cybersecurity solutions, implementing best practices, and providing cybersecurity training programs, Sabancı Group aims to enhance its resilience to cyber threats and seize opportunities for growth in the digital landscape. To this end, Sabancı Holding established the Digital Strategic Business Unit (SBU). This new SBU aims to foster existing digital business capabilities and accelerate new investments and initiatives in target areas. In this regard, in 2022, the wholly owned subsidiary of Sabancı Holding, Dx BV, invested in Radiflow, one of the world’s leading start-ups in the cybersecurity space, particularly in the operational technologies segment; and SEM, which operates in the data-oriented digital marketing space.

TREND

The integration of generative AI with sustainable business practices continues to gain momentum and offers opportunities for innovation and environmental stewardship. AI is used for developing systems to monitor environmental changes and predict potential issues, enabling proactive sustainability measures. AI combined with fields like nanotechnology and synthetic biology drives innovation in green chemistry, optimizing processes for eco-friendly materials and products. AI platforms facilitate collaboration among researchers, leading to breakthroughs in sustainable technologies and materials. AI-powered tools raise public awareness about sustainable practices, driving demand for sustainable products and services.

EMERGING RISK

For Sabancı Holding, which prioritizes digital and AI transformation as part of its strategic roadmap, generative AI presents several risks. Algorithmic biases in AI models might lead to unfair selection processes in HR programs. Intellectual property issues with AI-generated content could lead to legal disputes, impacting the company’s investments in technology and digital services. Data privacy concerns and cybersecurity threats pose significant risks to the sensitive financial and personal da ta handled by the company. Ethical dilemmas surrounding the use of generative AI, particularly in digital services, could affect stakeholder confidence. Regulatory uncertainty and the costs of compliance may complicate AI integration across business units, while the economic impact of job displacement might necessitate workforce reskilling and adaptation. Ensuring the quality and reliability of AI-generated outputs is critical, especially for maintaining the integrity of digital and omnichannel strategies. Addressing these risks requires robust governance, ethical guidelines, and continuous investment in AI security and compliance frameworks.

RELATED MATERIAL ISSUES

Digital Technologies, Risk Management and Resilience, Corporate Governance, Talent Management

OUR RESPONSE

Sabancı Holding continues to advance its investments in artificial intelligence through Sabancı Ventures, focusing on post-revenue scale-up startups. Additionally, X-Teams, a business development platform utilizing agile methodology, aims to identify potential business areas aligned with the Group’s strategies. It was done with a particular emphasis on applications based on GenAI in 2023. To address algorithmic risks associated with AI, Sabancı Holding ensures that its AI applications align with both regulations and internal policies. For instance, the AI algorithm used for human resources is crafted and tested to comply with the Group's diversity and inclusion policies while protecting the personal data in comply with the Data Protection Law. For further details please visit Digitalization for Sustainable Business Models section.

OPPORTUNITIES

Leveraging generative AI for sustainable innovation can unlock new opportunities for Sabancı Group, such as optimizing resource use, reducing en vironmental impact, and enhancing product development processes. Moreover, AI-driven solutions can improve operational efficiency, drive cost savings , and enhance decision-making capabilities, positioning Sabancı Group for long-term success in a rapidly evolving business landscape.

TREND

Economic sanctions and trade wars, characterized by targeted sanctions and trade barriers, are tools for political pressure. Technological competition and decoupling, focusing on tech sovereignty and supply chain realignment, aim to reduce dependency on foreign technologies. Increasing geopolitical tensions and economic fragmentation pose risks to global businesses. In the current global landscape, societal and political polarization is enhancing interstate armed conflicts and complex geopolitical dynamics. Governments have deployed large fiscal stimulus measures to enhance economic resilience, but mounting debt leverage poses challenges, especially with upcoming national elections in more than 50 countries in 2024, both developed and emerging.

State intervention for economic advantages is evident as nations seek to secure their well-being and global standing, potentially leading to inefficiencies and price rises. Geopolitical tensions and economic fragmentation exacerbate these challenges, potentially causing widespread debt distress in the coming decade.

EMERGING RISK

For Sabancı Holding, geoeconomic confrontations pose significant risks due to Sabancı Holding's global presence and the location of its main operations. From a business perspective, economic sanctions and trade wars could disrupt supply chains and increase costs, affecting profitability and market stability. Additionally, economic protectionism and fluctuating currency values may creat e financial instability, while regional trade agreements change market dynamics, requiring constant adaptation.

RELATED MATERIAL ISSUES

Risk Management and Resilience, Financial Performance, Collaboration and Effective Communication with Stakeholders

OUR RESPONSE

Sabancı Group maintains strategic agility and resilience, emphasizing dynamic portfolio management and financial performance. Investments in diverse markets and robust risk management strategies mitigate risks associated with geo-economic confrontation. In a challenging economic landscape, we achieved a combined revenue increase of 57%, a combined EBITDA growth of 23% and a consolidated net income increase of 20%, all without inflation adjustments and in line with our midterm guidance. Additionally, we remain on track to meet our targets for New Economy and FX share as a percentage of our total revenue. While exceeding financial targets, particularly income statement metrics, we maintained our focus on cash generation, keeping our balance sheet rock solid. In fact, we recorded a historic high year-end cash position at the Holding-level on an annualized basis. Our net debt to EBITDA ratio remains well below our midterm target, providing a solid foundation for further investment. For further details please visit Our Value Creation section.

OPPORTUNITIES

Despite the challenges posed by geo-economic confrontation, Sabancı Group targets to capitalize on opportunities in new growth platforms, transform and diversify its portfolio through dynamic management. Strategic partnerships and collaborations, impact investments seeking solid synergies and value creation opportunities with the ambition to support Sustainable Development Goals facilitate Sabancı Group’s growth, while proactive risk management mitigates potential disruptions and safeguard financial health.

TREND

Emerging technologies in climate and nature are driving significant advancements, presenting both risks and opportunities in the sustainability landscape. Innovations in renewable energy, such as enhanced solar and wind power, offshore wind farms, and next-generation solar technologies, are increasing efficiency and reducing costs. Energy storage solutions, including advanced battery technologies and grid-scale storage, are significant for integrating renewable energy into the grid. Carbon capture, utilization, and storage (CCUS) technologies, like direct air capture and carbon utilization, offer potential for reducing atmospheric CO2 levels. Climate-resilient infrastructure and smart cities are optimizing resource use, while nature-based solutions like reforestation. Lastly, climate finance and carbon markets, such as green bonds and carbon trading systems, are providing financial incentives for sustainable practices. Embracing these technologies can mitigate risks associated with climate change and environmental degradation while unlocking new opportunities for sustainable growth.

EMERGING RISK

Failing to invest in emerging climate and nature technologies in a timely manner, along with potential inadequacies or failures of these investments, can result in significant financial losses and hinder progress toward sustainability goals. Additionally, the rapid pace of innovation may overcome the ability of existing infrastructure and workforce to adapt, increasing vulnerability to cyber threats and other disruptions. It is significant for organizations to proactively invest and strategically plan to stay ahead in the evolving sustainability landscape.

RELATED MATERIAL ISSUES

Digital Technologies, Innovation and R&D, Climate Emergency, Responsible Investment and Sustainable Business Models

OUR RESPONSE

As Türkiye's first holding company that committed to achieving Net Zero emissions by 2050, we place energy and climate technologies at the core of our growth strategy within the 'new economy' framework. We introduced several groundbreaking climate technologies to Türkiye, including the first green hydrogen production facility in Bandırma. Our international investments extend to hydrogen equipment in Singapore and hydrogen storage technologies in Switzerland. In the United States, we engage in investments in cutting-edge fusion and deep geothermal energy technologies through Sabancı Renewables.

Our commitment to the new economy is concrete, with an ambitious goal to increase our renewable energy capacity to 75% by 2030 and achieve 100% by 2050. In parallel, our global footprint is expanding, as evidenced by our investment in U.S. solar power plants, poised to reach 500 MW within a year – a figure we plan to double swiftly.

By 2026, our renewable portfolio will exceed 4 GW, encompassing Europe's largest onshore wind energy project in global phase. For further details please visit Investing in New Growth Platforms section.

OPPORTUNITIES

By pioneering climate and nature technologies, Sabancı Group withholds a competitive advantage in the rapidly evolving sustainability market. Collaborating with technology partners and research institutions accelerates innovation and drives product development, positioning the Group as a leader in sustainable solutions and opening up new market opportunities globally. Sabancı Group's commitment to expanding renewable energy capacity presents investment opportunities in various sectors such as solar, wind, hydrogen production, and storage technologies. Sabancı Group's investments locally and internationally present opportunities for technology transfer and knowledge exchange. Overall, Sabancı Group's initiatives provide a platform for various stakeholders to capitalize on the growing demand for sustainable energy solutions and contribute to the transition towards a low-carbon economy.

Sustainability for a Better

Life 2023 Report

Sustainability for a Better

Life 2023 Report