Governance Echoes of Harmony: Strengthening Responsible Business Model Through Governance At Sabancı Holding, our corporate governance model emphasizes accountability, transparency, responsible business conduct, and effective stakeholder management, contributing to the sustainability and resilience of the Sabancı Group.

Sabancı Group acknowledges that a sound corporate governance system is the key driver of financial and extra-financial success. Based on this understanding, we design corporate governance practices that apply across Sabancı Group with primary attention to accountability, transparency, responsible business, and effective stakeholder management that contribute to the sustainability and resilience of Sabancı Group.

By incorporating double-materiality analysis into our strategy, we ensure that our decisions not only consider traditional financial metrics but also account for their broader societal and environmental implications. This integrated approach enables us to align our business practices with sustainability goals while simultaneously maximizing long-term value creation for all stakeholders.

For detailed information on Risk and Opportunity Management, Integration of Sustainability into Strategy, Three Lines Model in Sabancı Holding, Enterprise Risk Management at Sabancı Group and more, please download Our Governance Section.

Board of

Directors

Please click here for the detailed resumes of the Members of the Board of Directors.

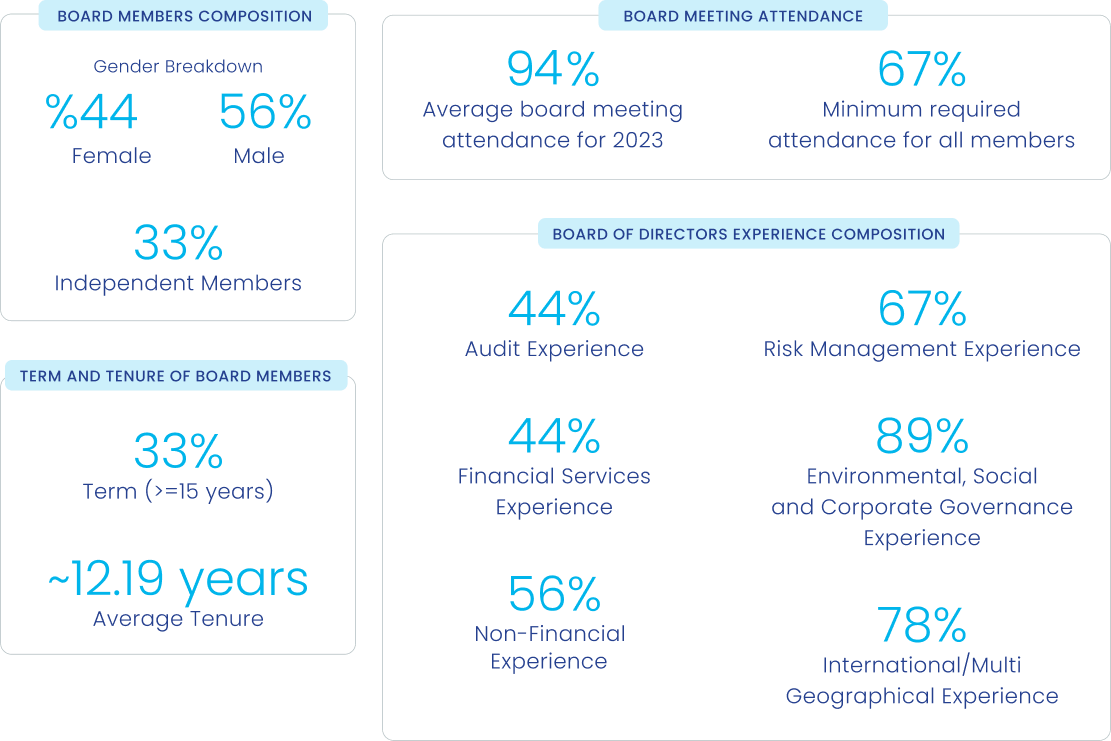

Skill Matrix

At Sabancı Holding, we believe that a Board of Directors enriched with a broad spectrum of skills, knowledge, and experience enhances its functionality and the quality of its decision-making processes. Studies indicate that companies with diverse boards see a 36% increase in profitability compared to their counterparts.

Our nomination process for the Board of Directors goes beyond merely ensuring gender equality in diversity and inclusion. We meticulously assess candidates' competencies, considering a wide array of factors, including industry expertise, management experience, proficiency in ESG matters, crisis management skills, and a capacity for global and long-term strategic thinking.

We uphold a strict non-discrimination policy, ensuring that no candidate is discriminated against based on gender, age, ethnicity, religion, language, race, or any other characteristic.

Executive

Committee

Please click here for the detailed resumes of the Members of the Executive Committee.

Committees and

Policies

Sabancı Holding has established a robust framework of committees dedicated to upholding the principles of good corporate governance and sustainability. In addition to Board Committees, the Holding has formed other committees such as Board of Ethics, Data Protection Committee, Risk Coordination Committee, Sustainability Leadership Committee, Investment Committee, Communication Committee and more.

Sabancı Holding's Sustainability Director is a member of the Investment Committee, underlining the sustainability-integrated governance, decision-making structure, and business model of Sabancı Holding. This strategic inclusion ensures that all investment decisions are aligned with Sabancı Holding's commitment to sustainable practices, promoting long-term value creation and responsible growth. By embedding sustainability at the core of its governance framework, Sabancı Holding is better positioned to address environmental, social, and governance (ESG) considerations, ultimately driving the business towards a more resilient and sustainable future.

Additionally, the Sustainability Team is an integral part of the Mergers and Acquisitions (“M&A”) process, ensuring that all potential acquisitions align with Sabancı Holding Responsible Investment Policy. The team conducts thorough ESG due diligence and sustainability business model assessment on prospective companies, evaluating their environmental, social, and governance practices to identify any risks and opportunities. This assessment helps to ensure that new investments contribute positively to Holding's sustainability objectives and long-term strategy. By incorporating ESG due diligence into the M&A process, Sabancı Holding reinforces its commitment to responsible growth and sustainable value creation.

- Audit Committee

- Corporate Governance, Nomination and Remuneration Committee

- Early Detection of Risk Committee

- Sustainability Committee

- Board of Ethics

- Data Protection Committee

- Risk Coordination Committee

- Sustainability Leadership Committee

- Invesment Committee

- Communication Committee

- Donations and Grants Policy

- Dividend Policy

- Disclosure Policy

- Wages Policy

- Corporate Social Responsibility Policy and Principles

- Health and Safety Policy

- Communication Principles

- Environmental Policy

For detailed information about each policy, please click on the headline of the relevant policy.

Sustainability for a Better

Life 2023 Report

Sustainability for a Better

Life 2023 Report