Business Areas Echoes of Harmony: Building Bridges for Sustainable Development

At Sabancı Holding, we believe that our culture of sustainability-linked R&D and innovation not only unlocks opportunities for growth but also fosters the creation of shared value on the path to achieving Sustainable Development Goals.

We believe that growth in sustainable business models is deeply intertwined with business development and innovation. For this reason, Sabancı Holding forms business development and innovation teams with diversified backgrounds to transform those new economy themes into fresh business opportunities on the various growth platforms.

We build ecosystems that create synergies among each other, enabling us to enhance our intellectual capital in the new economy.

R&D and

Innovation

In 2023, Sabancı Holding continued its strategic emphasis on research and development (R&D) and innovation, aligning efforts with our commitment to driving sustainable growth and embracing emerging technologies.

Recognizing the role of digital technologies in shaping the future economy, we intensified our efforts to move digitalization initiatives forward. Through strategic partnerships and targeted investments, we aimed to enhance digital capabilities and foster innovation in the rapidly evolving digital landscape. Moreover, sustainability remained a cornerstone of our innovation agenda. We deepened our commitment to SDG-linked R&D and innovation activities, to address pressing environmental challenges while unlocking new opportunities for growth. By investing in sustainable growth platforms, we sought to create shared value for stakeholders and contribute to the achievement of the Sustainable Development Goals (SDGs).

In parallel, we continued to make strategic investments in emerging technologies, recognizing their disruptive potential in reshaping industries and driving sustainable growth. Through partnerships with innovative startups and ventures, we aimed to leverage the ecosystem's growth potential and foster collaboration between startups and established enterprises. From digital factory platforms to industrial wearables and AI-powered virtual assistants, our investments spanned diverse sectors, positioning us at the forefront of technological innovation.

Furthermore, we spread a culture of innovation across our organization and portfolio companies, fostering creativity, experimentation, and cross-functional collaboration. Through initiatives such as hackathons, innovation challenges, and talent development programs, we empowered our teams to think boldly and drive meaningful change in the rapidly evolving business landscape.

* Includes Aksigorta, Agesa, Akçansa, Brisa, Carrefoursa, Çimsa, Kordsa, Teknosa, Temsa, Enerjisa Enerji, Enerjisa Üretim, SabancıDx

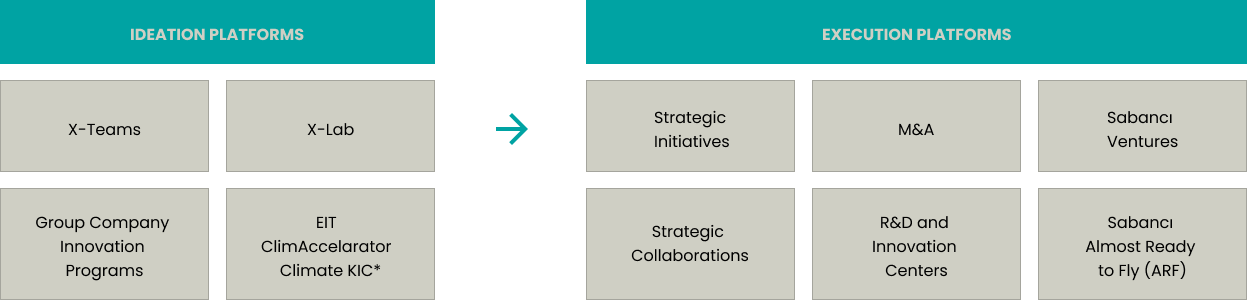

At Sabancı Holding, the innovation and transformation process is seen as a funnel that includes Discovery, Ideation, Incubation & Commercialization, and Scale-Up, respectively. These elements are positioned to foster growth and innovation across the Group companies. The innovation and transformation funnel is based on four key stages: X-Lab, X-Teams, the accelerator program Sabancı ARF, and Sabancı Ventures.

X-Lab focuses on establishing an innovative perspective by using design thinking, lean start-up and other innovation-based methods within Sabancı Group companies.

X-Teams verifies the problem area, evaluates scalability, searches and analyzes suitable solution areas/new technologies in order to assess Sabancı Group’s competencies within this framework and to develop a roadmap forward.

Sabancı ARF (Almost Ready to Fly) is the Group’s early-stage acceleration program. This 20-week program includes seed funding at the outset and a potential follow-on investment on demo day, mentorship, networking and collaboration opportunities with Group companies. Sabancı ARF is designed for selected start-ups (open to both Group companies and external start-ups by application) to help them scale up quickly.

Sabancı Ventures is the corporate venture capital arm of the Group. As a corporate VC fund, Sabancı Ventures invests in commercialized post-revenue scale-ups and seeks out solid synergies and value creation opportunities for both its investment targets and Sabancı Group companies.

*European Institute of Innovation & Technology (EIT) ClimAccelarator Climate KIC is a global programme for start-ups to innovate, catalyse and scale the potential of their climate solutions.

*European Institute of Innovation & Technology (EIT) ClimAccelarator Climate KIC is a global programme for start-ups to innovate, catalyse and scale the potential of their climate solutions.

Sabancı Global Technology

Center GmbH (SGTC)

In 2023, Sabancı Holding, has invested EUR 2.2 million to Sabancı Global Technology Center (SGTC) located at the Technical University of Munich (TUM).

SGTC sets an example of robust university-industry collaboration in Europe and underscores Sabancı Group's commitment to foster sustainable development.

The state-of-the-art facility will serve as a hub for innovation and research for Sabancı Group companies Çimsa and Kordsa.

SGTC is equipped with eight specialized cutting-edge laboratories fostering advanced research in fields such as material technologies, and construction reinforcement. Products developed in Çimsa and Kordsa factories in Türkiye will be reintroduced to the European market at SGTC.

SGTC's model, serving Sabancı Group’s purpose to 'unite Türkiye and the World' will also be one of the driving forces behind Türkiye's value-added export mobilization.

With a diverse team comprising professionals from six different nations, SGTC embodies international collaboration and expertise. Moreover, the Çimsa and Kordsa teams are led by two women executives, surpassing the UNESCO Institute of Statistics’ level of 30% women employed in R&D activities worldwide.

Committed to sustainability driven innovation, Sabancı Group increased the total number of R&D and technology centers to eight, six in Türkiye and two abroad with SGTC in Germany and Kordsa’s Asia Pacific Technical Center in Indonesia both opened in 2023.

Moreover, Sabancı Holding explores variety of models for university-industry collaborations such as MIT Energy Initiative Future Energy Systems Center in the USA, of which Enerjisa companies are members and Composite Technologies Excellence Center, established through the Sabancı University-Kordsa collaboration.

In summary, our R&D and innovation efforts in 2023 were characterized by a strategic focus on digital transformation, sustainability, and collaboration with the broader ecosystem. By remaining agile, adaptive, and forward-thinking, we are confident in our ability to navigate the challenges ahead and unlock new opportunities for growth, differentiation, and value creation.

Digitalization for Sustainable

Business Models

The digital strategy of Sabancı Group aims to accelerate the digital transformation of its companies and Türkiye, while also enabling scalable business models and international expansion. To support this vision, Sabancı Holding established the Digital Strategic Business Unit (SBU), which is dedicated to fostering existing digital capabilities and accelerating new investments in key areas.

In 2023, under the leadership of Mr. Max Roger Speur, the Digital SBU focused on enhancing cloud business infrastructure and services through SabancıDx and supporting digital marketing and cybersecurity growth through its companies Opportune and Radiflow.

Looking forward, Sabancı Group’s digital and tech retail business unit plans to intensify its sustainability initiatives, expand product offerings, and implement a blended digital and physical strategy.

The vision is to create an integrated digital value proposition for connected enterprises, leveraging cloud, big data, and transformation capabilities.

The Group’s extensive know-how, strategic partnerships, and global resource access are significant in driving growth across the digital value chain. Future initiatives will prioritize investments in emerging markets and next-generation technologies, ensuring a sustainable and innovative digital future for Sabancı Group.

Sabancı Holding is committed to integrating digitalization into its sustainability strategy, recognizing it as an important driver for achieving Group’s future-focused sustainability targets.

By leveraging technology, Holding aims to embracing significant trends and opportunities that enhance our business models and sustainability practices.

To ensure accountability and progress, digitalization-related annual KPIs are integrated into the performance assessment of our related Executive Committee members. These top decision-makers, who also serve on the boards of various Sabancı Group companies, play a leading role in accelerating Sabancı Holding’s digital transformation efforts.

Sabancı Holding leverages the capabilities of its enabler companies, SabancıDx and Teknosa, for digital transformation strategies while also digitize data management systems ensuring the transparency and accuracy of sustainability-related data in its internal processes.

Accordingly, in 2023, Sabancı Holding invested in Pulsora’s, which is a digital platform for ESG data management, USD 20M Series A funding round through Sabancı Climate Ventures. This investment is an indicator of a commitment to leveraging advanced technology to improve data quality and accuracy. With Pulsora’s expertise, Sabancı Holding aims to enhance the data collected by Group companies, covering environmental, social, occupational health and safety (OHS), economic, and governance metrics.

Growing Ambition in

AI Technologies

SabancıDx has solidified its position as a leading provider of multi and hybrid cloud solutions, aligning with the Digital SBU’s strategic objectives in the digital market.

A strategic partnership with Microsoft has enhanced Sabancı’s cloud value proposition, incorporating Azure capabilities within Türkiye. This cooperation focuses on offering hybrid cloud solutions to meet both local and global customer needs. Additionally, the collaboration with Microsoft extends to the Cloud Solution Center, which bolsters hybrid cloud and artificial intelligence competencies within Türkiye’s digital ecosystem. This agreement also presents significant expansion opportunities for SabancıDx in Southeast Europe, Central and Eastern Europe, and the Middle East and Africa, facilitating market access and generating foreign currency revenue. Beyond the Microsoft partnership, SabancıDx has initiated cloud infrastructure partnerships with major brands, utilizing the expertise of digital native talent to implement and manage cloud solutions effectively, thereby better serving its expanding customer base.

Furthermore, Sabancı Ventures also acts as a “sensor” for Group companies to identify new growth areas, actively evaluating investment opportunities with innovative business models and/or cutting-edge technologies. SV focuses on digital-related areas such as Internet of Things (IoT), artificial intelligence (AI) and big data, climate tech, insurtech, health tech, fintech, mobility, advanced materials, and cloud tech.

For exemplary applications and solutions of Sabancı Group Companies on Digitalization for Sustainable Business Models, please download Transforming Our Core Business Areas Section.

Environmental Investments

and Expenditures

As Sabancı Group, we classify environmental expenditures into two categories: those required for regulatory compliance purposes (mandated by law) and those not mandated by law. In 2023, the environmental expenditures of Group companies exceeded TL 354 million. Of these environmental expenditures, 67% consists of those not mandated by law (i.e., those that extend beyond regulatory compliance).

Environmental investments in our growth areas approached TL 8.9 billion in 2023 alone. We follow these investments across three categories regarding their contribution to sustainable development. Accordingly, the largest environmental investment in 2023 was realized in the mitigation investments category with 64%.

*Usually refers to operational expenses (OpEx) or capital expenditures (CapEx), such as the purchase of energy efficiency equipment or modernization. It is aimed at making existing activities more sustainable. Routine maintenance-repair, environmental measurement, etc. expenses are not included. It expresses expenditures that results reduction in raw materials, waste or GHG emissions.

**Usually refers to capital expenditures (CapEx). Growth investments in the Sabancı Holding's core business areas are included in this category. This includes the relevant M&A activities.

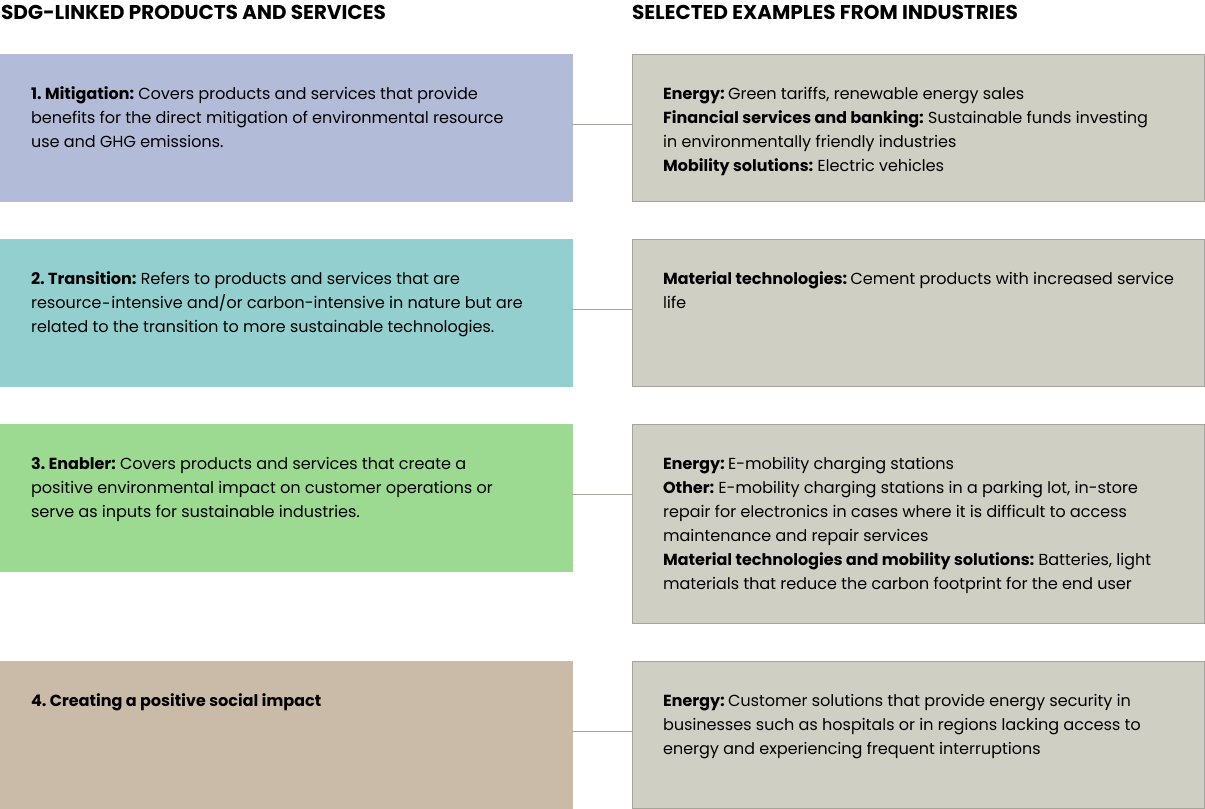

1.Mitigation Investments: Mitigation investments include activities that greatly mitigate resource use or GHG emissions and directly contribute to sustainable development.

2.Transition Investments: This refers to investments in products and services that are resource-intensive and/or carbon-intensive in nature but can be considered a transition to more sustainable technologies, such as cement products produced using alternative raw materials and/or fuels.

3.Enabler Investments: Environmental investments made for enabling purposes refer to investments in products that are not considered direct resource use or carbon emission reduction activities but provide inputs to related industries or enable deployment.

SDG-Linked Products

and Services

Sabancı Holding’s commitment to transform its portfolio towards sustainable business models is deeply rooted in its strategic framework emphasizing the need for decarbonization across various industries.

This commitment includes investments in SDG-linked products and services which are significant steps upon accelerating the transformation towards decarbonized businesses in a diversified portfolio, aligned with our focus on responsible investment and sustainable business models.

We monitor products and services that reduce resource usage and GHG emissions, facilitate the transition to more sustainable technologies, support the deployment of these technologies, and create a positive social impact.

We initiate a mindset shift across all Sabancı Group companies while also regulating and monitoring SDG-linked products and services according to our internal classification system based on global standards and best practices to guide our investment decisions on SDG-linked economic activities. We continuously improve and foster our transformation towards a sustainable portfolio, as a driver of positive change.

We intend to echo this mindset of investing for a better and sustainable future across all Sabancı Group companies. We monitor SDG-linked products and services under four categories: mitigation, transition, enabler and creating a positive social impact.

*Akbank is not included. Akbank’s performance regarding its sustainable business model is monitored under the Sustainable Finance heading.

For world’s leading innovative SDG-Linked Products and Services of Sabancı Group Companies, please download Transforming Our Core Business Areas Section.

Sustainable

Finance

The transformation of finance is essential to achieving a sustainable future. In sustainable finance, environmental considerations might include climate change mitigation and adaptation and the environment more broadly, for instance, preserving biodiversity, pollution prevention, reducing water consumption and the circular economy. Social considerations could refer to inequality, inclusiveness, labor relations, investment in human capital and communities, and human rights issues.

During the reporting year, our Group companies in the financial services and banking sector have continued efforts to increase their sustainable finance activities. Meanwhile, the rest of the Group enjoyed the lower finance cost and favorable conditions in its new investments through green and sustainable finance solutions. Finally, we benefited from financial incentives to enhance our investments in renewable energy technologies through Sabancı Climate Ventures. In 2023, Sabancı Climate Ventures secured tax equity financing totaling USD 184 million for the Cutlass Solar II Project, a 272 MW solar energy investment in the US. This project represents a significant step in our commitment to sustainable energy and demonstrates our ability to leverage financial opportunities for impactful initiatives.

Sustainability for a Better

Life 2023 Report

Sustainability for a Better

Life 2023 Report