Refining Vision for

Scalable Growth

Just as an optical lens gathers and concentrates light to reveal clarity and amplify energy, Sabancı Holding sharpens its focus to magnify the long-term value of its

investments. Our portfolio transformation is driven by strategic foresight and precision, ensuring that every capital allocation strengthens our position in the industries of the future. Rooted in sustainability and focused on scalable growth, we invest in new growth

platforms with an emphasis on energy and climate technologies, material technologies,

mobility solutions and digital technologies. Pursuing our path of innovation, resilience,

and global expansion, we identify businesses that are built to thrive.

Transforming Our Portfolio For Scalable, Sustainable Growth

At Sabancı Group, we are strengthening our global

presence by driving transformation toward a sustainable

future and creating long-term value for our stakeholders.

In 2024, we advanced our portfolio transformation

through a strategic and disciplined capital allocation

framework — reinforcing our core businesses while

expanding into new growth platforms. These platforms,

including energy and climate technologies, material

technologies, mobility solutions, and digital technologies,

are selected based on their alignment with our strategic

direction and sustainability priorities.

This evolution is grounded in our strong financial foundation and robust governance model. Together, they provide the clarity, agility, opportunity-focus, operational efficiency, and resilience needed to deliver meaningful impact.

Investing in New Growth Platforms

Driving Future Growth Through Strategic Investment and Interconnected Transition

We look ahead and seize new opportunities aligned with our

sustainability goals. Across our M&A and corporate venture

capital activities, we apply a structured evaluation process

that prioritizes scalability, strategic fit, and alignment

with our sustainability agenda. We focus on capturing

opportunities in disruptive technologies with long-term

growth potential. These governance mechanisms ensure

that new investments not only support growth but also

enhance portfolio resilience and risk diversification.

More than reacting to global trends, we are proactively investing in areas where Sabancı Group can lead — leveraging our industrial capabilities, cross-sectoral expertise, and ecosystem reach. We continue to cultivate partnerships with startups, technology developers, and strategic players to strengthen our innovation capacity and gain early access to future markets.

As Sabancı Group, we began tracking SDG-linked activities in 2022. In 2024, we allocated TL 6.5 billion to investments in these areas, reinforcing our commitment to aligning long-term financial performance with social and environmental impact.

Leading Strategic Transitions

We are investing in new growth platforms and accelerating solutions across four strategic pathways:

For detailed information on our operations under Energy and Climate Technologies, Material Technologies, Mobility Solutions and Digital Technologies, please download Transforming Our Portfolio Section.

Impact Investment

Fostering Innovation Through Corporate Venture Capital

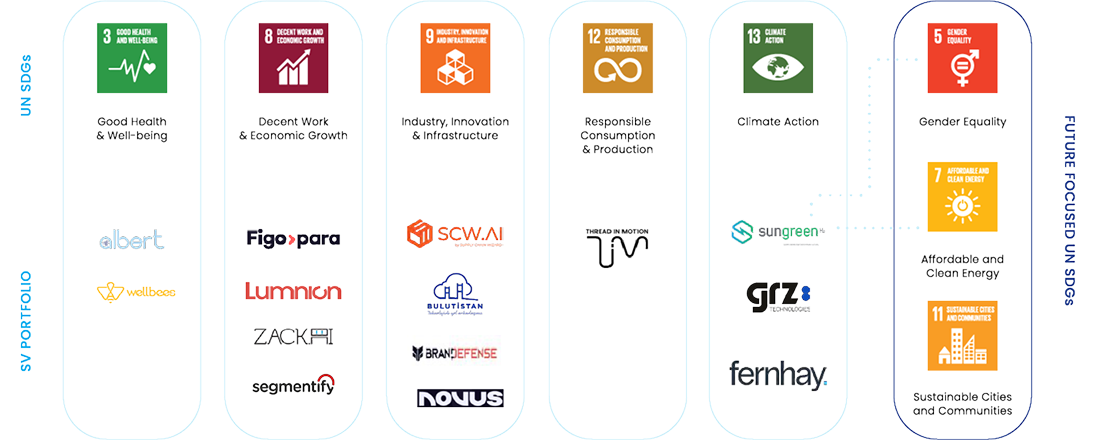

Sabancı Ventures (SV) is the corporate venture capital arm of Sabancı Holding. SV adopts global best practices and creates value for both startups and the Group by formalizing commercial partnership plans and leveraging the know-how, operational excellence, and global network of Sabancı Group companies. SV accepts the UN Principles for Responsible Investment (PRI) as a guide for evaluating investment decisions. It typically invests in post-revenue scale-ups, prioritizing synergies that unlock long-term growth and transformation opportunities within the Group. Investments focus on companies led by exceptional founders with scalable business models and global ambition, generally at the post-seed to Series A stage.

Deploying Capital With Strategic Intent

Sabancı Ventures acts as a “sensor” for Group companies to identify new growth areas, actively evaluating ventures with innovative business models and cutting-edge technologies. In alignment with Sabancı Holding’s strategic initiatives, SV targets four focus areas: digital technologies, advanced material technologies, energy and climate solutions, and mobility solutions.

Sabancı Ventures has made direct corporate venture capital investments in 14 companies across five countries, deploying over USD 14 million to date.

As part of its broader corporate venture capital strategy, Sabancı Group has utilized multiple investment vehicles, reaching over 25 direct investments globally and deploying more than USD 60 million in total CVC-related capital since 2020.

Integrating Sustainability into the Investment Lifecycle

Considerations related to sustainability and the UN Sustainable Development Goals (SDGs) are embedded across every stage of the SV investment lifecycle. Each portfolio company is linked to at least one UN SDG, with impact KPIs defined pre-investment in collaboration with startup teams. Progress is monitored and reported quarterly.

| Sustainability for a Better Life 2024 Report

| Sustainability for a Better Life 2024 Report